Buyer Credit

Loan Programme for Financing Foreign Buyers / Buyers' Banks (full text of the Programme)

All terms and conditions under this Programme are in accordance with the Rules of the OECD Consensus.

Pursuant to the Conflict of Interest Prevention Act (Official Gazette of the Republic of Croatia Nos. 26/11, 12/12, 126/12, 57/15) and all subsequent changes and amendments, restrictions are in force on lending to business entities whose ownership interests are owned by public officials and their family members. The provisions of these restrictions are deemed a constituent part of HBOR loan programmes. The full wording of the restrictions can be found at: Restrictions on Lending to State Officials.

Loan amount

0.25% p.a. charged on the undisbursed loan amount

bank guarantee

All terms and conditions under this Programme are in accordance with the Rules of the OECD Consensus.

1. Borrowers

- foreign buyer if covered by acceptable collateral, or

- commercial bank of foreign buyer, with whom exporter has concluded export contract

Pursuant to the Conflict of Interest Prevention Act (Official Gazette of the Republic of Croatia Nos. 26/11, 12/12, 126/12, 57/15) and all subsequent changes and amendments, restrictions are in force on lending to business entities whose ownership interests are owned by public officials and their family members. The provisions of these restrictions are deemed a constituent part of HBOR loan programmes. The full wording of the restrictions can be found at: Restrictions on Lending to State Officials.

2. Purpose of loans

- financing exports of goods and services, except consumer goods, pursuant to the rules determined by the OECD Consensus

- collection of payment for export transaction immediately upon delivery

- payment to the account of exporter in the currency of export contract

- loan is repaid by bank/buyer abroad

- increase in liquidity of exporter

- avoidance of risk of collecting payment for export transaction

3. Manner of Implementation

- co-financing export transactions with other banks, or

- financing the bank or the buyer abroad on its own

4. Loan Amount, Disbursement Period and Repayment

Loan amount

- up to 100% of the export contract value for repayment periods of up to two years,

- up to 85% of the export contract value for repayment periods of over two years,

- loans are denominated in the export contract currency

- pursuant to the terms and conditions of the export contract

- up to 10 years depending on the type of goods and/or services exported

- as an exception, up to 15 years for financing the construction of hydro or thermal power plants, projects based on wind energy, geothermal, solar and bio energy projects, tide power plant projects and water supply and wastewater disposal projects

5. Interest

| Fixed interest rate | CIRR + margin Margin on CIRR ranges from 0.2%, depending on the creditworthiness of the buyer/bank, the export transaction and the importing country. |

| Variable interest rate | LIBOR/EURIBOR + margin Margin depends on the creditworthiness of the buyer/bank, the importing country and the export transaction. |

6. Loan application fee

0.5% one-off, charged on the contracted loan amount

7. Commitment fee

0.25% p.a. charged on the undisbursed loan amount

8. Security

bank guarantee

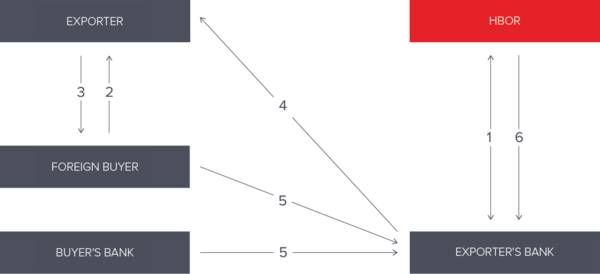

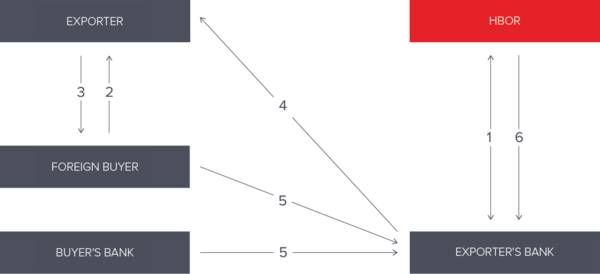

9. Scheme

FAQ

FAQ