Insurance against losses during the production

If you produce goods on a special order from a foreign buyer that cannot be sold to another buyer, you can protect yourself also against the risk of losses during the production. In such a case, you are insured against the inability to fulfil an export contract caused by the foreign buyer’s termination or the occurrence of political risk event that prevents the fulfilment of the export contract (e.g. embargo on exports to the buyer’s country);

Insurance against the risk of the foreign buyer’s termination of export contract or the risk of inability to export goods can be concluded under a policy of insuring the collection of export receivables.

Indemnity is paid in the amount of actual costs arisen during the process of producing certain goods minus the percentage of retention, i.e. your contracted share in the loss.

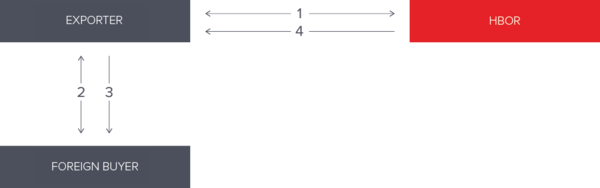

1. The exporter concludes an insurance contract with HBOR and pays the insurance premium;

2. The exporter concludes the contract on sale of goods with the foreign buyer;

3. The foreign buyer cancels the export contract or the exporter is not able to perform the export contract;

4. HBOR pays indemnity to the exporter.

Insurance against the risk of the foreign buyer’s termination of export contract or the risk of inability to export goods can be concluded under a policy of insuring the collection of export receivables.

Indemnity is paid in the amount of actual costs arisen during the process of producing certain goods minus the percentage of retention, i.e. your contracted share in the loss.

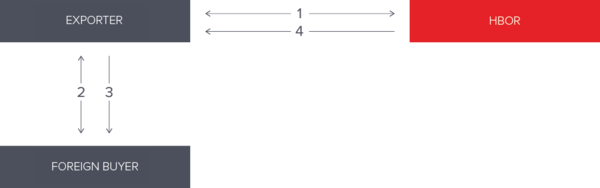

Insurance scheme

1. The exporter concludes an insurance contract with HBOR and pays the insurance premium;

2. The exporter concludes the contract on sale of goods with the foreign buyer;

3. The foreign buyer cancels the export contract or the exporter is not able to perform the export contract;

4. HBOR pays indemnity to the exporter.