Supplier Credit Insurance Programme

If you are an exporter of capital goods or services or if you perform construction works abroad, and the buyer requires, as a basic condition for concluding an export contract, sale of goods or performance of services with deferred payment, you can enter into an insurance contract with HBOR that provides coverage against non-payment of your foreign buyer.

Advantages of an insurance policy

- You are insured against non-payment of your foreign buyer caused by commercial (e.g., financial difficulties of the buyer, bankruptcy) and political risks (e.g., war, natural disasters, financial problems in the buyer country).

- In addition to credit risk insurance, you can also contract manufacturing risk insurance, i.e., the impossibility of performing the export contract due to the occurrence of one of the insured risks.

- If you sell goods or services to a foreign buyer with deferred payment, you do not have to finance it yourself. Your bank can grant you a loan after having performed exports, and you can assign the insurance policy to the bank as loan collateral.

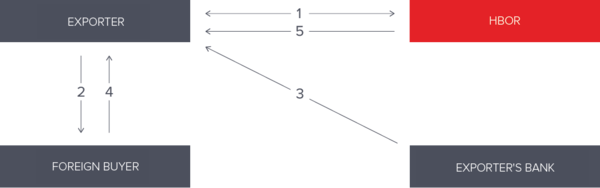

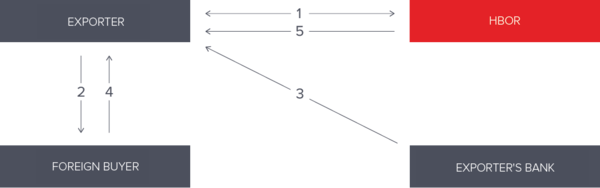

Insurance scheme

- The exporter concludes insurance policy with HBOR and pays insurance premium;

- The exporter delivers goods or renders services to the foreign buyer;

- The exporter, after having duly exported the goods or performed the services under the export contract, collects payment from the loan granted to it by its bank; the maturity of the loan is in line with the payment terms and conditions determined in the export contract, and the insurance policy is bank’s collateral;

- The foreign buyer pays for the goods or services under the export contract in accordance with the agreed terms and conditions, and these payments are used to repay the loan of the exporter’s bank;

- If the foreign buyer fails to pay upon maturity under the export contract, the exporter submits a claim to HBOR, and HBOR makes the payment to the exporter or indemnifies the bank.