Insurance of buyer credit or buyer’s bank credit

If you are an exporter of capital goods and/or services whose commercial bank grants a loan to the foreign buyer for the purchase of your goods and services, you can enter into an insurance contract with HBOR that provides coverage for the collection of export receivables.

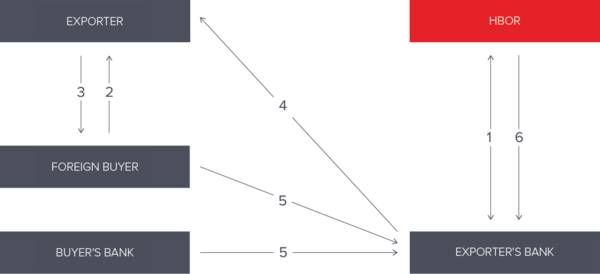

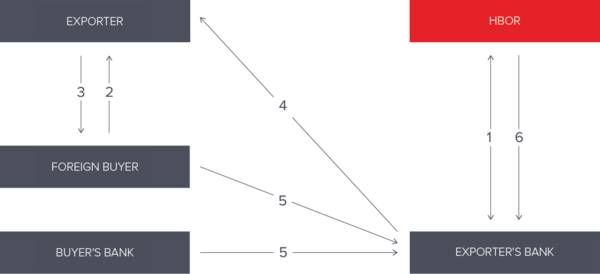

1. The bank concludes an insurance contract with HBOR and the insurance premium is paid; 2. The exporter concludes an export contract with the foreign buyer; 3. The exporter delivers goods or renders services to the foreign buyer; 4. The banks disburses loan funds to the exporter's account; 5. The foreign buyer repays the loan. 6. If the foreign buyer does not repay the loan, HBOR pays indemnity to the bank.

1. The bank concludes an insurance contract with HBOR and the insurance premium is paid; 2. The exporter concludes an export contract with the foreign buyer; 3. The exporter delivers goods or renders services to the foreign buyer; 4. The banks disburses loan funds to the exporter's account; 5. The foreign buyer repays the loan. 6. If the foreign buyer does not repay the loan, HBOR pays indemnity to the bank.

General Terms and Conditions

Advantages of an insurance policy

- A loan is directly granted to the foreign buyer or the foreign buyer’s bank, and the proceeds of the loan are disbursed to the exporter’s account, whereas the loan is repaid by the foreign buyer or the foreign buyer’s bank;

- Possibility of financing foreign buyers with longer maturities;

- Insurance of loan repayment to the lender against commercial and political risks;

- It is possible to insure up to 95% of the receivables based on loan principal and ordinary contractual interest, whereas the level of coverage depends on the risk of the buyer’s country.

Insurance scheme

1. The bank concludes an insurance contract with HBOR and the insurance premium is paid; 2. The exporter concludes an export contract with the foreign buyer; 3. The exporter delivers goods or renders services to the foreign buyer; 4. The banks disburses loan funds to the exporter's account; 5. The foreign buyer repays the loan. 6. If the foreign buyer does not repay the loan, HBOR pays indemnity to the bank.

1. The bank concludes an insurance contract with HBOR and the insurance premium is paid; 2. The exporter concludes an export contract with the foreign buyer; 3. The exporter delivers goods or renders services to the foreign buyer; 4. The banks disburses loan funds to the exporter's account; 5. The foreign buyer repays the loan. 6. If the foreign buyer does not repay the loan, HBOR pays indemnity to the bank.General Terms and Conditions